/institutional/perspectives/macroeconomic-research/macroeconomic-research-fed-needs-to-act-to-prevent

Macroeconomic Update: Fed Needs to Act to Prevent Normalization Turning into a Downturn

Shift to Fed easing cycle helps brighten the economic outlook, but risks remain.

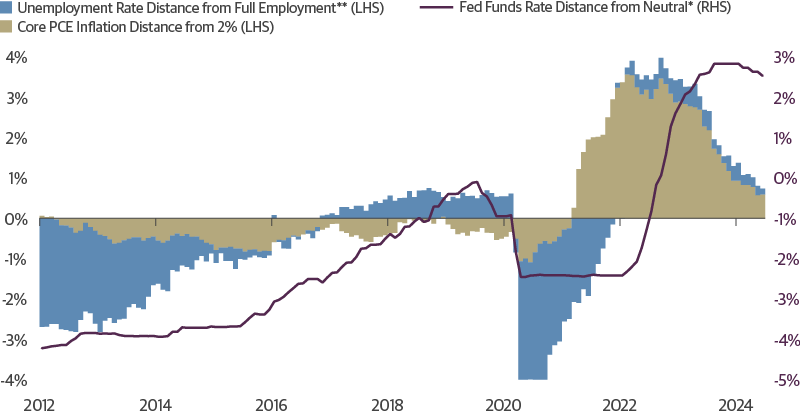

The U.S. has returned to conditions that look more like “normal.” The overheated labor market of 2021–2023 has seen demand for workers cool alongside expansion of available labor supply, causing the unemployment rate to drift upward from 3.4 percent to 4.3 percent over the past year and a half. Fed officials now describe the labor market as in “rough balance” and back to conditions seen before the pandemic.

Meanwhile, substantial progress has been made in bringing inflation back down to the Fed’s 2 percent target. Following a hot first quarter, recent months have seen renewed progress in the inflation fight, bringing core personal consumption expenditures (PCE) inflation down to 2.6 percent in year-over-year terms and 2.3 percent annualized in the three months through June. This inflation progress looks to be durable for two key reasons: First is the rebalanced labor market and associated cooling in wage growth. Second is the slowdown underway in shelter inflation, which has been the biggest contributor to above target inflation but which finally saw a long-awaited slowdown in the June inflation data. Leading indicators of rent inflation, particularly prices for newly signed leases, suggest this slowdown should stick and help inflation remain low for at least the next few quarters.

With the economy getting back to normal, the Fed should soon follow suit with its rate policy. Fed officials are increasingly acknowledging that if they wait too long to bring interest rates down, they risk turning this normalization into more of a slowdown, or even recession. The July employment report seemed to validate those fears just days after the Fed decided to hold rates steady at the July meeting, with the unemployment rate rising 20 basis points and job growth outside healthcare and government up just 33,000. Compounding downside risks, recession fears, questions around AI, and foreign spillovers have highlighted vulnerability to an equity-led tightening in financial conditions.

The emergence of these downside risks, which we have previously flagged, raises the risk that the normalization the Fed has been seeking turns into a slowdown, or even recession. We expect the Fed will respond by cutting rates faster than previously expected, with at least three 25 basis point rate cuts this year, and the potential for larger cuts if the labor market data continues to weaken. More importantly, we see downside risk to the terminal fed funds rate from what is priced into the market, which is conditional on a soft landing. Easing cycles are usually faster than tightening cycles, and this tightening cycle was historically fast. There is risk around market expectations of a ladder step easing.

Can the Fed Stop Further Job Slowdown Without Reigniting Inflation?

We expect the Fed will respond by cutting rates faster than previously expected, with at least three 25 basis point rate cuts this year, and potential for larger cuts if the labor market data continues to weaken.

Source: Guggenheim Investments, Haver Analytics. Data as of 6.30.2024. *Neutral is FOMC Median Longer Run estimate in the Summary of Economic Projections. ** Full Employment is FOMC median Longer run estimate.

—By Matt Bush and Maria Giraldo

Important Notices and Disclosures

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

This material contains opinions of the authors, but not necessarily those of Guggenheim Partners, LLC or its subsidiaries. The opinions contained herein are subject to change without notice. Forward-looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Investing involves risk, including the possible loss of principal. In general, the value of a fixed-income security falls when interest rates rise and rises when interest rates fall. Longer term bonds are more sensitive to interest rate changes and subject to greater volatility than those with shorter maturities. During periods of declining rates, the interest rates on floating rate securities generally reset downward and their value is unlikely to rise to the same extent as comparable fixed rate securities. Investors in asset-backed securities, including mortgage-backed securities and collateralized loan obligations (“CLOs”), generally receive payments that are part interest and part return of principal. These payments may vary based on the rate loans are repaid. Some asset-backed securities may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices volatile and they are subject to liquidity and valuation risk. CLOs bear similar risks to investing in loans directly, such as credit, interest rate, counterparty, prepayment, liquidity, and valuation risks. Loans are often below investment grade, may be unrated, and typically offer a fixed or floating interest rate.

Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Partners Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, and GS GAMMA Advisors, LLC.

GPIM 62342

VIDEOS AND PODCASTS

Maria Giraldo, Investment Strategist for Guggenheim Investments, joins Asset TV’s Fixed Income Masterclass.

Steve Brown, Chief Investment Officer for Fixed Income, joins Macro Markets to discuss portfolio strategy and our outlook following the U.S. election and the Fed’s most recent rate cut.

©

Guggenheim Investments. All rights reserved.

*Assets under management is as of 9.30.2024 and includes leverage of $14.8bn. Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Wealth Solutions, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, GS GAMMA Advisors, LLC, and Guggenheim Private Investments, LLC.

By choosing an option below, the next time you return to the site, your home page will automatically

be set to this site. You can change your preference at any time.

We have saved your site preference as

Institutional Investors. To change this, update your

preferences.

United States Important Legal Information

By confirming below that you are an Institutional Investor, you will gain access to information on this website (the “Website”) that is intended exclusively for Institutional Investors and, as such, the information should not be relied upon by individual investors. This Website and any product, content, information, tools or services provided or available through the Website (collectively, the “Services”) are provided to Institutional Investors for informational purposes only and do not constitute a recommendation to buy or sell any security or fund interest. Nothing on the Website shall be considered a solicitation for the offering of any investment product or service to any person in any jurisdiction where such solicitation or offering may not lawfully be made. By accessing this Website, you expressly acknowledge and agree that the Website and the Services provided on or through the Website are provided on an as is/as available basis, and except as partnered by law, neither Guggenheim Investments and it parents, subsidiaries and affiliates nor any third party has any responsibility to maintain the website or the Services offered on or through the Website or to supply corrections or updates for the same. You understand that the information provided on this Website is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. You also agree that the terms provided herein with respect to the access and use of the Website are supplemental to and shall not void or modify the Terms of Use in effect for the Website. The information on this Website is solely intended for use by Institutional Investors as defined below: banks, savings and loan associations, insurance companies, and registered investment companies; registered investment advisers; individual investors and other entities with total assets of at least $50 million; governmental entities; employee benefit (retirement) plans, or multiple employee benefit plans offered to employees of the same employer, that in the aggregate have at least 100 participants, but does not include any participant of such plans; member firms or registered person of such a member; or person(s) acting solely on behalf of any such Institutional Investor.

By clicking the "I confirm" information link the user agrees that: “I have read the terms detailed and confirm that I am an Institutional Investor and that I wish to proceed.”