/institutional/perspectives/macroeconomic-research/fed-shifting-to-easing-mode-inflation-labor-cool

Macroeconomic Update: Fed Shifting to Easing Mode as Inflation and Labor Market Cool

Shift to Fed easing cycle helps brighten the economic outlook, but risks remain.

Economic conditions have been in a sweet spot recently, with solid real gross domestic product (GDP) growth, a labor market cooling toward a more sustainable pace even with layoffs remaining very low, and inflation arguably already back under the Fed’s 2 percent target (see for example core PCE inflation over the last six months). Whether by design or just good luck, the most acute negative impacts from the Fed’s tightening were largely cushioned by expansive fiscal policy in 2023. Meanwhile, inflation managed to cool significantly despite solid—but slowing—aggregate demand because the supply side showed rapid improvement, including both from international supply chains and expansion of the labor force.

As we look to the rest of 2024, the market seems to be extrapolating that this positive confluence of economic forces will continue to strike a perfect balance. That is a real possibility, particularly with the Fed making a more dovish shift and the associated easing in financial conditions taking some pressure off the economy. But in our view the long list of macroeconomic risks is underappreciated.

Chief among these risks is a further cooling in demand that transitions the economy from a gradual slowdown to an abrupt downshift. Job growth has been narrowly concentrated in just a few industries and could weaken further, especially now that the length of the workweek has been reduced aggressively. We also worry that the aggregate economic data are hiding stress under the surface in areas like small businesses, small banks, low-income consumers, and commercial real estate. We expect stress in these areas, many of which lie outside public markets, will stay relatively contained, but we are on watch for spillovers. And while not our base case, a risk in the other direction is that progress on inflation stalls or even reverses, whether due to new supply or commodity price shocks (increased shipping costs or higher oil prices from Mideast tensions come to mind) or demand not cooling enough.

The economic outlook has gotten more positive now that further Fed hikes are off the table and broad financial conditions are easing as substantial rate cuts are priced in. But with markets priced for such a benign outlook, we continue to expect volatility as risks of something upsetting the favorable growth-inflation mix remain elevated.

Can the Fed Stop Further Job Slowdown Without Reigniting Inflation?

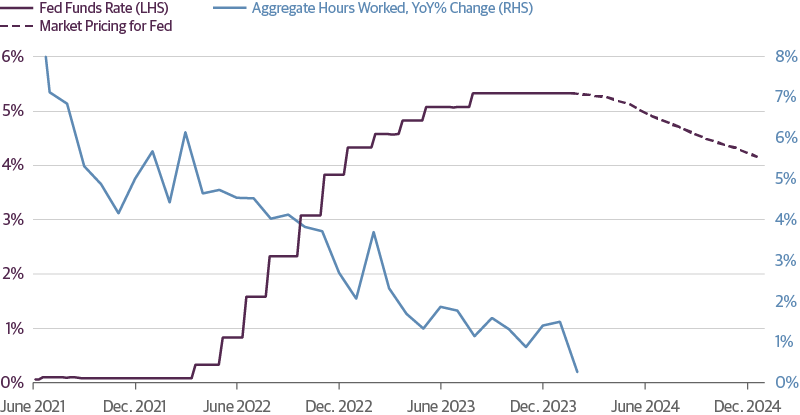

Job growth has been narrowly concentrated in just a few industries and could weaken further, especially now that the length of the workweek has been reduced aggressively, which as our chart shows, has stalled the year over year growth rate in aggregate hours worked.

Source: Guggenheim Investments, Bloomberg, Haver. Data as of 1.22.2024 for fed funds, 12.31.2023 for payrolls. Aggregate hours worked is average weekly hours x total employed workers.

—By Matt Bush and Maria Giraldo

Important Notices and Disclosures

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

This material contains opinions of the authors, but not necessarily those of Guggenheim Partners, LLC or its subsidiaries. The opinions contained herein are subject to change without notice. Forward-looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Investing involves risk, including the possible loss of principal. In general, the value of a fixed-income security falls when interest rates rise and rises when interest rates fall. Longer term bonds are more sensitive to interest rate changes and subject to greater volatility than those with shorter maturities. During periods of declining rates, the interest rates on floating rate securities generally reset downward and their value is unlikely to rise to the same extent as comparable fixed rate securities. Investors in asset-backed securities, including mortgage-backed securities and collateralized loan obligations (“CLOs”), generally receive payments that are part interest and part return of principal. These payments may vary based on the rate loans are repaid. Some asset-backed securities may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices volatile and they are subject to liquidity and valuation risk. CLOs bear similar risks to investing in loans directly, such as credit, interest rate, counterparty, prepayment, liquidity, and valuation risks. Loans are often below investment grade, may be unrated, and typically offer a fixed or floating interest rate.

Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Partners Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, and GS GAMMA Advisors, LLC.

GPIM 60474

VIDEOS AND PODCASTS

Maria Giraldo, Investment Strategist for Guggenheim Investments, joins Asset TV’s Fixed Income Masterclass.

Steve Brown, Chief Investment Officer for Fixed Income, joins Macro Markets to discuss portfolio strategy and our outlook following the U.S. election and the Fed’s most recent rate cut.

©

Guggenheim Investments. All rights reserved.

*Assets under management is as of 12.31.2024 and includes leverage of $14.8bn. Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Wealth Solutions, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, GS GAMMA Advisors, LLC, and Guggenheim Private Investments, LLC.

By choosing an option below, the next time you return to the site, your home page will automatically

be set to this site. You can change your preference at any time.

We have saved your site preference as

Institutional Investors. To change this, update your

preferences.

United States Important Legal Information

By confirming below that you are an Institutional Investor, you will gain access to information on this website (the “Website”) that is intended exclusively for Institutional Investors and, as such, the information should not be relied upon by individual investors. This Website and any product, content, information, tools or services provided or available through the Website (collectively, the “Services”) are provided to Institutional Investors for informational purposes only and do not constitute a recommendation to buy or sell any security or fund interest. Nothing on the Website shall be considered a solicitation for the offering of any investment product or service to any person in any jurisdiction where such solicitation or offering may not lawfully be made. By accessing this Website, you expressly acknowledge and agree that the Website and the Services provided on or through the Website are provided on an as is/as available basis, and except as partnered by law, neither Guggenheim Investments and it parents, subsidiaries and affiliates nor any third party has any responsibility to maintain the website or the Services offered on or through the Website or to supply corrections or updates for the same. You understand that the information provided on this Website is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. You also agree that the terms provided herein with respect to the access and use of the Website are supplemental to and shall not void or modify the Terms of Use in effect for the Website. The information on this Website is solely intended for use by Institutional Investors as defined below: banks, savings and loan associations, insurance companies, and registered investment companies; registered investment advisers; individual investors and other entities with total assets of at least $50 million; governmental entities; employee benefit (retirement) plans, or multiple employee benefit plans offered to employees of the same employer, that in the aggregate have at least 100 participants, but does not include any participant of such plans; member firms or registered person of such a member; or person(s) acting solely on behalf of any such Institutional Investor.

By clicking the "I confirm" information link the user agrees that: “I have read the terms detailed and confirm that I am an Institutional Investor and that I wish to proceed.”