/institutional/perspectives/sector-views/high-yield-and-bank-loan-outlook-july-2024

Lessons from the Distress Ratio: Stay Constructive on Higher Quality High Yield and Bank Loans

Distress ratios suggest manageable default rates.

High Yield and Bank Loan Outlook

Third Quarter 2024

High yield credit spreads and bank loan discount margins remain near multi-year tight levels at 300 basis points and just below 500 basis points, respectively. Nevertheless, there is considerable bifurcation in these markets, with an aggregate of nearly $200 billion in bonds and loans trading at distressed levels. While this figure might seem elevated, it represents less than 10 percent of the total market, which is well within historical norms outside of recessionary periods. We remain constructive on higher quality high yield and bank loans, but avoid these distressed credits.

The state of the distressed market informs our overall view of leveraged credit. Distress ratios often exceed realized default rates, and absent an economic downturn or shock, we expect defaults in the leveraged credit market to plateau in coming months. However, pockets of stress remain, particularly in capital intensive sectors like media and communications, and even traditionally defensive sectors like healthcare have debt priced with a high likelihood to default. We therefore continue to find opportunities on a name-by-name basis without intentionally overweighting or underweighting any one industry due to its inherent cyclicality. Investors can find value even in traditional cyclical industries.

Report highlights:

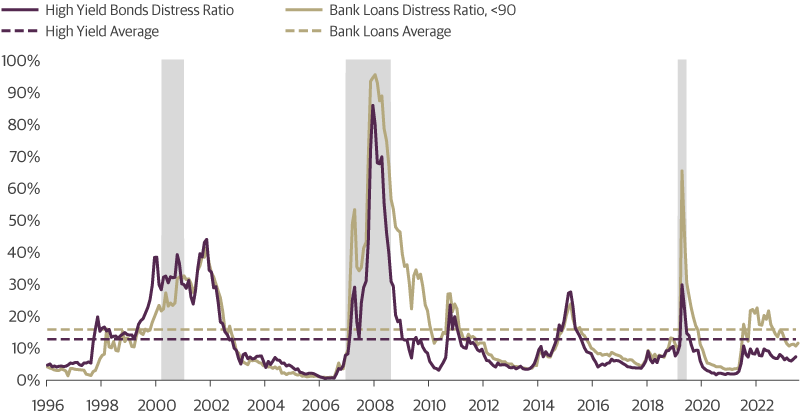

- The current distress ratios of 7 percent in the ICE BofA High Yield Index and 11.5 percent in the Credit Suisse Leveraged Loan Index are below their historical averages, suggesting a manageable level of market stress. It is important to note that this publication only reviews the publicly traded market and not direct lending or private debt where default risk may have migrated.

- We define distressed debt as bonds trading at spreads of 1,000 or more basis points and loans priced below 90 percent of par.

- The communications industry has the highest volume of distressed debt outstanding, representing 36 percent of total debt priced as distressed, given its significant industry aggregate leverage ratio (7.1x) and low interest coverage (2.7x).

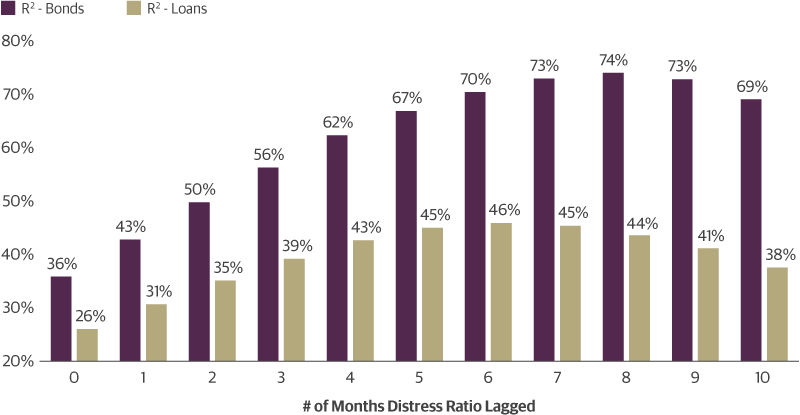

- Distress ratios are a useful indicator of expected defaults in the high yield corporate bond market, but a less useful one for loans based on our examination of the historical relationships.

Macroeconomic Outlook

A Continued Slowdown in Growth Should Lead to Rate Cuts This Year

We continue to anticipate that a slowing economy and cooling inflation will lead to Federal Reserve (Fed) rate cuts later this year. Despite the median fed funds rate dot plot in the Federal Open Market Committee’s June Summary of Economic Projections (SEP) showing just one rate cut in 2024, our baseline view is that two rate cuts are more likely given signs that the labor market is coming into better balance and inflation is continuing to cool. Market expectations have shifted closer to our baseline view.

Recent data points support our outlook for a gradual slowdown in economic growth. Retail sales were softer than expected in May and the June report showed consumers shifting spending toward categories where prices have declined, with notable impact to restaurant spending, reflecting more consumer caution. Industrial production grew more than expected in May, up 0.9 percent, in contrast to more subdued survey measures from the New York and Philadelphia Fed. This divergence highlights the mixed signals in the economy, where some sectors exhibit resilience while others weaken. Tracking estimates point to 2.1 percent annualized GDP growth for the second quarter and 1.6 percent for the third quarter.

Fed Chair Jerome Powell noted that overall labor market conditions are no longer overheated. The Fed is considering a broad array of labor market evidence, including job openings and hiring rates, which have declined notably. The labor market’s softening aligns with our view that, with fiscal support fading and the effects of elevated rates still pinching some sectors, consumer spending will continue to moderate.

Against this backdrop, we expect real GDP growth to slow to below 2 percent year over year by the end of the 2024. Risks to our growth outlook are weighted to the downside: The labor market could weaken more than we forecast, and struggling sectors like low income consumers, small businesses, and commercial real estate could spill over into risk premiums. Recession risk remains above normal, reinforcing the need for cautious monitoring of economic developments.

Distress Ratios Suggest Defaults Will Be Manageable

Investors are pricing in approximately $200 billion in bonds and loans that are considered highly likely to default, i.e. distressed. We defined distressed debt as bonds trading at spreads of 1,000 or more basis points (in other words, yields exceeding 10 percent above benchmark Treasurys), and for loans it includes those priced below 90 percent of par.

Although $200 billion may seem substantial, it should not unduly concern investors, in our view. The leveraged credit market is approximately $2.6 trillion in size, so this figure represents a distress ratio of just 8 percent. This includes bonds and loans that are generally not index eligible. The distress ratio in the ICE BofA High Yield Index is 7.3 percent and for the Credit Suisse Leveraged Loan Index it is 11.5 percent using the same criteria. Both the corporate bond and bank loan distress ratios are below their historical averages, supporting the market’s expectation of better than average outcomes based on the current economic outlook.

Distress Ratios Are Below Historical Averages

Distress Ratio Based on Debt Outstanding

Source: Guggenheim Investments, ICE Index Services, Credit Suisse. Data as of 6.30.2024. The ratio for high yield bonds is based on the ICE BofA High Yield Index and for bank loans is based on the Credit Suisse Leverage Loan Index. Gray areas represent recession.

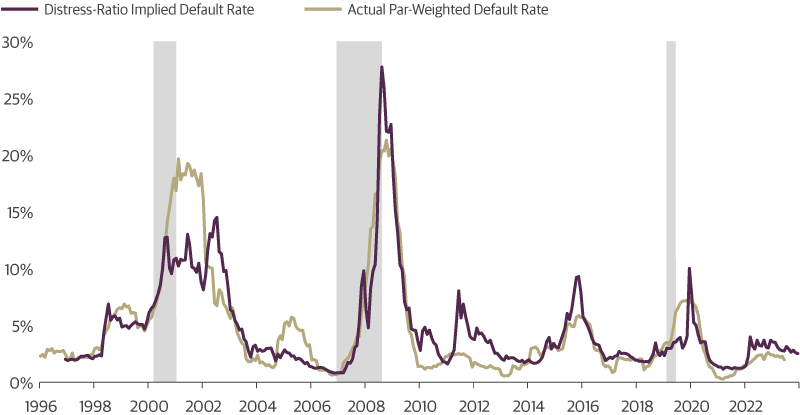

For high yield corporates, the distress ratio has been a good indicator of likely defaults within the next nine–12 months, with a linear regression R-square (a measure of explanatory power) at 74 percent using data since 1997, indicating a strong relationship. This simple linear model implies a default rate of about 2.5 percent for 2024 versus 2 percent as of the end of May. These rates are well below the historical average default rate of 4.6 percent since 1997.

Distress Ratios Trends Show an Expected Plateau in Default

Actual Par Default Rate and Implied by Market Pricing

Source: Guggenheim Investments, BofA Merrill Lynch Global Research, ICE Index Services. Data as of 5.30.2024. Gray areas represent recession.

Although we always consider a margin of error in these simple models, we think the distress ratio is a fairly reliable gauge of the market’s anticipated direction for near-term defaults in high yield corporate bonds. However, this relationship is considerably weaker for loans. Analyzing a variety of leads and lags between the loan distress ratio and the market’s default series, the best R-square value is 46 percent with the distress ratio leading defaults by six months. Moreover, data segmentation between pre-2010 and post-2010 shows a significant weakening in this relationship for loans in particular.

One reason for the weaker relationship for loans is that sponsors are increasingly delaying or preventing defaults through negotiations with lenders. Another is that distressed loan borrowers may have more financing options compared to unsecured bond borrowers when they are in trouble. As a result, loan distress ratios are a less reliable leading indicator of defaults within this sector.

The Relationship Between Loan Distress Ratio and Defaults Is Weaker

R2 Between Distress Ratios and Default Rates by Sector with Various Lags

Source: Guggenheim Investments, ICE Index Services, Credit Suisse, BofA Merrill Lynch Global Research. Data as of 5.31.2024.

Capital Intensive Communications Experiencing the Greatest Distress

There is a slightly higher amount of distressed loans ($116 billion) compared to U.S. corporate bonds ($85 billion), with the greatest cumulative concentration across both markets in the media and communications industry. This one industry has $72 billion in debt priced as distressed, representing 36 percent of the total distressed volume, owing to its high leverage, weak interest coverage, fierce competition, and secular trends that have impacted customer retention. One example of such a trend is consumer “cord-cutting” that has left traditional cable providers more vulnerable in this environment where operating costs have risen and financing is difficult to obtain.

Below investment-grade communications borrowers with publicly available fundamental data have an aggregate leverage ratio of 7.1x and an interest coverage of just 2.7x, the highest leverage and lowest interest coverage when compared to other sectors. High interest rates and concerns about loss given default from most recent default situations (both in and out of the communications sector) has significantly limited this sector’s financing availability, which is painful for a capital intensive business model.

Media/Telecom Carries the Highest Leverage and Lowest Interest Coverage

Aggregate Leverage and Interest Coverage by Sector

Source: Guggenheim Investments, S&P Capital IQ, Bloomberg. Data as of 3.31.2024, based on Q1 2024 reported earnings. Includes both high yield corporate bond and leverage loan issuers with public financials.

We believe the current environment favors active credit selection and a solid understanding of a company’s ability to navigate a high rate environment with a bifurcated consumer economy, with or without high leverage. Some traditionally defensive sectors, such as utilities and healthcare, have high leverage ratios compared to other industries yet present a different picture of what the market is pricing in as distressed. The utilities sector has an aggregate leverage ratio of 6.5x and an interest coverage of 3.2x, but does not have any bonds or loans priced as distressed according to our approach. Healthcare has a leverage ratio of 5.1x and interest coverage of 3.1x, and the fourth-highest volume of debt priced as distressed, after technology and consumer discretionary. Each industry has different circumstances that amplify or mitigate the effect of operating with high leverage in this environment. We believe strong credits can be found even in traditionally cyclical sectors.

Investment Implications

Overall, we remain constructive on higher quality high yield and bank loans. Investors should be cautious of the communications sector, which accounts for 36 percent of distressed debt among high yield bonds and bank loans. The communications sector’s high leverage ratio (7.1x) and low interest coverage (2.7x) make it vulnerable to continued high-interest rates, presenting risks that must be carefully managed.

At the same time, investors should be wary of overweighting traditional defensive sectors like utilities and healthcare, or underweighting cyclical sectors like consumer discretionary. A bottom up credit analysis approach can more appropriately balance credit risks with compensation for that risk, especially in an environment of overall tight spreads. Within the consumer discretionary sector, we believe it is possible to find stronger financial profiles that offer more resilient investment opportunities.

Leveraged Credit Scorecard

As of 6.30.2024

High Yield Bonds

Bank Loans

Source: ICE BofA, Credit Suisse. *Discount Margin to Maturity assumes three-year average life. Past performance does not guarantee future results.

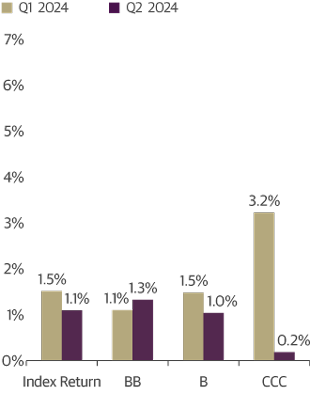

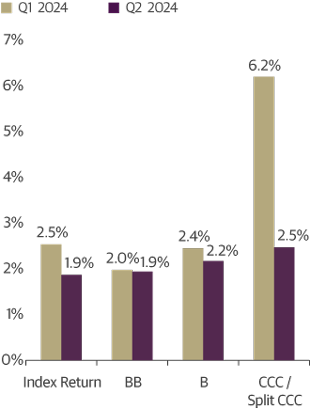

ICE BofA High Yield Index Returns

Source: ICE BofA. Data as of 6.30.2024. Past performance does not guarantee future results.

Credit Suisse Leveraged Loan Index Returns

Source: Credit Suisse. Data as of 6.30.2024. Past performance does not guarantee future results.

Important Notices and Disclosures

INDEX AND OTHER DEFINITIONS

The referenced indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees or expenses.

The Credit Suisse Leveraged Loan Index tracks the investable market of the U.S. dollar denominated leveraged loan market. It consists of issues rated “5B” or lower, meaning that the highest rated issues included in this index are Moody’s/S&P ratings of Baa1/BB+ or Ba1/ BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries.

The ICE BofA U.S. High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million. In addition, qualifying securities must have risk exposure to countries that are members of the FX-G10, Western Europe or territories of the US and Western Europe. The FX-G10 includes all Euro members, the U.S., Japan, the UK, Canada, Australia, New Zealand, Switzerland, Norway and Sweden.

A basis point (bps) is a unit of measure used to describe the percentage change in the value or rate of an instrument. One basis point is equivalent to 0.01 percent.

AAA is the highest possible rating for a bond. Bonds rated BBB or higher are considered investment grade. BB, B, and CCC-rated bonds are considered below investment grade and carry a higher risk of default, but offer higher return potential. A split bond rating occurs when rating agencies differ in their assessment of a bond.

The three-year discount margin to maturity (DMM), also referred to as discount margin, is the yield-to-refunding of a loan facility less the current three-month Libor rate, assuming a three year average life for the loan.

The interest coverage ratio is a debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt.

The leverage ratio is a metric that expresses how much of a company’s operations or assets are financed with borrowed money.

Spread is the difference in yield to a Treasury bond of comparable maturity.

Investing involves risk, including the possible loss of principal. In general, the value of a fixed-income security falls when interest rates rise and rises when interest rates fall. Longer term bonds are more sensitive to interest rate changes and subject to greater volatility than those with shorter maturities. During periods of declining rates, the interest rates on floating rate securities generally reset downward and their value is unlikely to rise to the same extent as comparable fixed rate securities. High yield and unrated debt securities are at a greater risk of default than investment grade bonds and may be less liquid, which may increase volatility. Investors in asset-backed securities, including mortgage-backed securities and collateralized loan obligations (“CLOs”), generally receive payments that are part interest and part return of principal. These payments may vary based on the rate loans are repaid. Some asset-backed securities may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices volatile and they are subject to liquidity and valuation risk. CLOs bear similar risks to investing in loans directly, such as credit, interest rate, counterparty, prepayment, liquidity, and valuation risks. Loans are often below investment grade, may be unrated, and typically offer a fixed or floating interest rate.

This article is distributed for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This article is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

This article contains opinions of the author but not necessarily those of Guggenheim Partners or its subsidiaries. The author’s opinions are subject to change without notice. Forward-looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

©2024, Guggenheim Partners, LLC. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. Guggenheim Funds Distributors, LLC is an affiliate of Guggenheim Partners, LLC. For information, call 800.345.7999 or 800.820.0888.

Member FINRA/SIPC GPIM 62025

Tune in to Macro Markets to hear the top minds of Guggenheim Investments offer timely analysis on financial market trends. Guests include portfolio managers, fixed income sector heads, members of the Macroeconomic and Investment Research Group, and more.

©

Guggenheim Investments. All rights reserved.

*Assets under management is as of 3.31.2025 and includes leverage of $15.2bn. Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Wealth Solutions, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, GS GAMMA Advisors, LLC, and Guggenheim Private Investments, LLC.

By choosing an option below, the next time you return to the site, your home page will automatically

be set to this site. You can change your preference at any time.

We have saved your site preference as

Institutional Investors. To change this, update your

preferences.

United States Important Legal Information

By confirming below that you are an Institutional Investor, you will gain access to information on this website (the “Website”) that is intended exclusively for Institutional Investors and, as such, the information should not be relied upon by individual investors. This Website and any product, content, information, tools or services provided or available through the Website (collectively, the “Services”) are provided to Institutional Investors for informational purposes only and do not constitute a recommendation to buy or sell any security or fund interest. Nothing on the Website shall be considered a solicitation for the offering of any investment product or service to any person in any jurisdiction where such solicitation or offering may not lawfully be made. By accessing this Website, you expressly acknowledge and agree that the Website and the Services provided on or through the Website are provided on an as is/as available basis, and except as partnered by law, neither Guggenheim Investments and it parents, subsidiaries and affiliates nor any third party has any responsibility to maintain the website or the Services offered on or through the Website or to supply corrections or updates for the same. You understand that the information provided on this Website is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. You also agree that the terms provided herein with respect to the access and use of the Website are supplemental to and shall not void or modify the Terms of Use in effect for the Website. The information on this Website is solely intended for use by Institutional Investors as defined below: banks, savings and loan associations, insurance companies, and registered investment companies; registered investment advisers; individual investors and other entities with total assets of at least $50 million; governmental entities; employee benefit (retirement) plans, or multiple employee benefit plans offered to employees of the same employer, that in the aggregate have at least 100 participants, but does not include any participant of such plans; member firms or registered person of such a member; or person(s) acting solely on behalf of any such Institutional Investor.

By clicking the "I confirm" information link the user agrees that: “I have read the terms detailed and confirm that I am an Institutional Investor and that I wish to proceed.”