/institutional/perspectives/portfolio-strategy/economic-cycle-isnt-dead-delayed-good-for-bonds

The Economic Cycle Isn’t Dead, Merely Delayed… And That’s Good for Bonds

Navigating an economic cycle where old patterns don’t seem to apply.

May 16, 2024

| By Anne Walsh, JD, CFA, Chief Investment Officer, Guggenheim Partners Investment Management

We find ourselves at a point in the economic cycle where old patterns don’t seem to apply. The 2s/10s Treasury yield curve has been inverted for 22 months, exceeding the old record of 20 months set in the Volcker era. Historically, the average time span between curve inversion and a recession has been 16 months. The Leading Economic Index has been on a declining trend for two years and conventional wisdom had been that a recession would follow after just four consecutive down months. Finally, it’s now been 26 months since the Federal Reserve started its hiking cycle and historically a recession would have started by now.

Economic forecasting relies heavily on analyzing patterns and outcomes from historical data. That faith in precedent provides the rationale for Sir John Templeton’s famous quote, “The four most dangerous words in investing are ‘this time it’s different.’” It also suggests a warning against recency bias that assumes the current situation not only differs from the past but that it will also persist into the future. This time last year, as inflation raged and rates climbed, market consensus held that zombie companies would go begging for credit, recession loomed and the Fed would ride to the rescue. But here we are a year later, and we seem to be in the exact same place. We have seen neither a full-blown recession nor a credit purge beyond the margin. We continue to watch a bifurcated economy in which lower income consumers and smaller companies are struggling, but higher income households and larger companies are doing just fine. The Fed’s expected rate cuts keep getting pushed back.

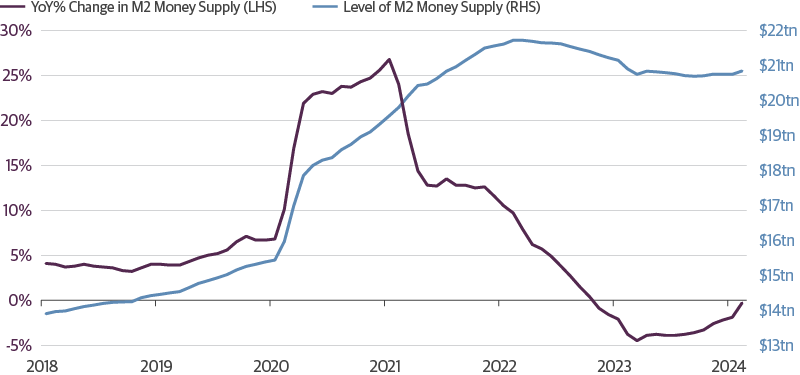

So is it different this time? Two critical developments have been making new and underappreciated contributions to the current situation. First, we are still deeply rooted in a post-COVID global economy contending with staggering amounts of stimulus: $12 trillion was added to global central bank balance sheets between 2020 and 2022, and even with quantitative tightening, only $5 trillion has been taken out. In the United States, M2 money supply growth—the flow—may have turned negative since jumping 41 percent from February 2020 to March 2022, but the stock of money supply is still near all-time highs.

M2 Money Supply Jumped Post-COVID and Remains Near All-Time Highs

Source: Guggenheim Investments, Bloomberg. Data as of 3.31.2024.

The seismic impact of monetary and fiscal stimulus was like a giant meteor crashing into the Pacific Ocean. The stimulus meteor created initial waves of liquidity that were strong enough to overcome the complete shutdown of the global economy in the depths of the pandemic. Subsequent waves helped pull the economy out of the depths, but in the United States the waves are still coming and there is still unspent stimulus in the system. The Fed isn’t fighting inflation, it is fighting the echo effects of all this stimulus. Counterfactual evidence supporting this concept is that other developed economies, which did not receive as much stimulus, have slowed down considerably while U.S. growth continues apace. This is unprecedented: It is different this time.

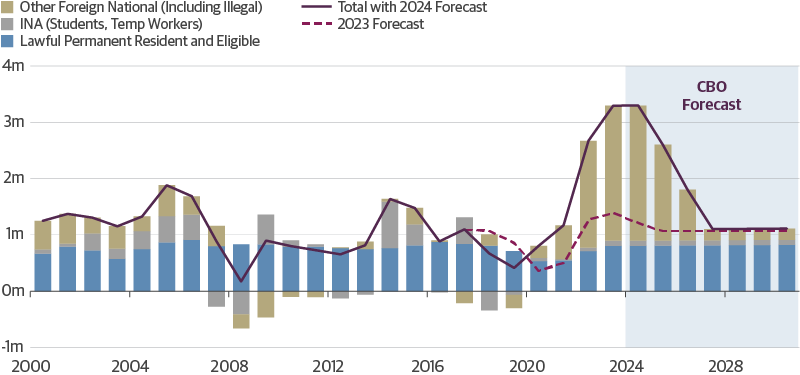

The other unusual factor in this cycle is the surge in immigration that has helped keep the labor market humming, but in the process has also skewed the economic data and made it less reliable. Recently updated demographic estimates from the Congressional Budget Office show a sharply higher estimate of net immigration, almost entirely due to illegal immigration. This immigration likely helped to meet excess labor demand in 2023, which created a positive supply shock that helped the economy expand even as inflation came down. One possible explanation for this dynamic is that immigrants have higher labor force participation rates, boosting supply more than demand, at least in the short term. The demand for rental housing by the influx of immigrants may also be distorting rental rates, which are the largest contributor to CPI inflation data.

Immigration Unexpectedly Surged in 2023, Driven by Illegal Entries

CBO Estimates of Annual Net Immigration by Category

Source: Guggenheim Investments, Congressional Budget Office. Estimates as of 1.18.2024.

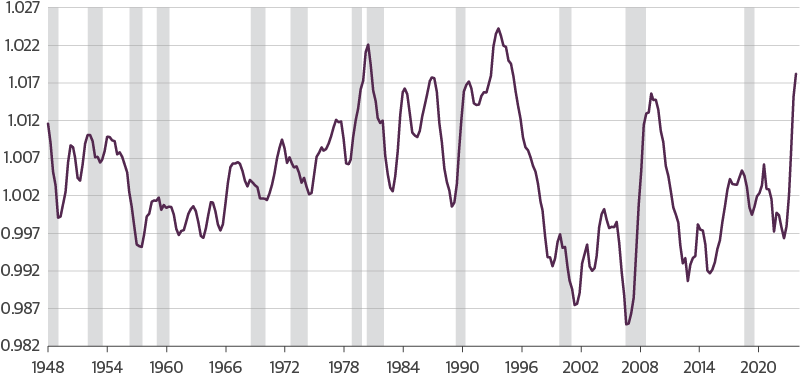

Immigration may also explain the recent disparity between gross domestic product (GDP) and gross domestic income (GDI)—the income generated from producing GDP. A potential reason for this discrepancy is that many immigrants have come to the United States to work, but they do not earn income in the traditional—i.e. trackable—sense because many are employed off the books. Immigrants are also being subsidized in many cases, so while they may not initially derive officially recorded income from work, they are also getting spending money directly received from state, city, and federal dollars. This combination of difficult to track income and easier to record spending likely contributed to this divergence between GDI and GDP. Real GDP is trending stronger than it otherwise would relative to real GDI, suggesting that undocumented workers’ consumption is supporting GDP, but the income they are receiving to support that spending is not picked up in GDI.

Illegal Immigrants’ Income Likely Caused GDP/GDI Divergence

Ratio of Real GDP to Real GDI

Source: Guggenheim Investments, Haver. Data as of 12.31.2023.

If historical cyclical patterns played out as they had in the past, we would have seen the downturn by now. But the business cycle isn’t dead, it has just been extended by the impact of extraordinary monetary and fiscal stimulus and increased immigration. While it may seem as if our economy is no longer sensitive to higher interest rates, the bite of higher rates has simply been delayed because corporate and consumer balance sheets were well-fortified during the multiyear period of ultra-low rates and high liquidity. This is one of the factors that may have delayed the downturn, but we believe it is still coming.

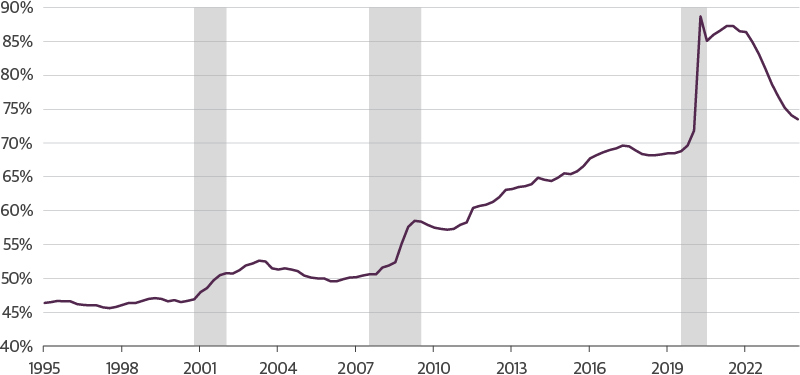

We are starting to see change occur at the margin. Default rates are staying stubbornly high. Credit card delinquency rates for lower income consumers are rising quickly. Stress in commercial real estate persists, particularly in the office sector. More households and companies will succumb to the stress of higher interest rates as the Fed stays higher for longer. Despite recent prints, the balance of evidence continues to support the late-cycle disinflationary trajectory as wage growth trends down and higher frequency measures of rent show signs of softness. The latest Fed Beige Book suggests only limited signs of reheating. Perhaps most importantly, the COVID echo should start to subside as the ratio of total M2 to GDP, while still high, falls towards the historical trend line.

While Still High, M2 Money Supply Has Declined Toward Its Historical Range

M2 Money Supply Divided by Nominal GDP

Source: Guggenheim Investments, Haver. Data as of 3.31.2024.

Higher-for-longer may fuel market volatility in the months ahead, but investors would be wise to remember that fixed income generally does well when the Fed is on pause. An extended or delayed economic cycle is not a bad environment for credit, but it makes sense to be somewhat defensive when adding to credit positions. We favor issuers that are at less risk of being unable to service their credit obligations. In addition, as the interest sensitive parts of this bifurcated economy increasingly struggle to access credit, less liquid sectors could present opportunities to earn yield at the margin. For example, as banks continue to exit lending to real estate, commercial mortgage loans could emerge as attractive value alternatives. Spreads are likely to remain tight, but nominal yields remain attractive and offer reasonable entry points, including in higher quality high yield.

Active investors have to remain nimble and take advantage of the markets as they find them and not remain fixed on what should be occurring based on historical precedent. Our job isn’t to predict the economy, it is to manage within dynamic markets. While it might be different this time—for now—the recessionary pressures are out there. The second half of the year could turn out to be very different from the first, which calls for careful positioning now.

Important Notices and Disclosures

Investing involves risk, including the possible loss of principal. Investments in fixed-income instruments are subject to interest rate risk. In general, the value of a fixed-income security falls when interest rates rise and rises when interest rates fall. Longer term bonds are more sensitive to interest rate changes and subject to greater volatility than those with shorter maturities. During periods of declining rates, because the interest rates on floating rate securities generally reset downward, their market value is unlikely to rise to the same extent as the value of comparable fixed rate securities. High yield and unrated debt securities are at a greater risk of default than investment grade bonds and may be less liquid, which may increase volatility. Investors in asset-backed securities, including mortgage-backed securities and collateralized loan obligations (“CLOs”), generally receive payments that are part interest and part return of principal. These payments may vary based on the rate loans are repaid. Some asset-backed securities may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices volatile and they are subject to liquidity and valuation risk. CLOs bear similar risks to investing in loans directly, such as credit, interest rate, counterparty, prepayment, liquidity, and valuation risks. Loans are often below investment grade, may be unrated, and typically offer a fixed or floating interest rate.

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

This material contains opinions of the author, but not necessarily those of Guggenheim Partners, LLC or its subsidiaries. The opinions contained herein are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. No part of this material may be reproduced or referred to in any form, without express written permission of Guggenheim Partners, LLC.

Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy or, nor liability for, decisions based on such information.

©2024, Guggenheim Partners, LLC. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. Guggenheim Funds Distributors, LLC is an affiliate of Guggenheim Partners, LLC. For information, call 800.345.7999 or 800.820.0888.

GPIM 61342

Tune in to Macro Markets to hear the top minds of Guggenheim Investments offer timely analysis on financial market trends. Guests include portfolio managers, fixed income sector heads, members of the Macroeconomic and Investment Research Group, and more.

©

Guggenheim Investments. All rights reserved.

*Assets under management is as of 3.31.2025 and includes leverage of $15.2bn. Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Wealth Solutions, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, GS GAMMA Advisors, LLC, and Guggenheim Private Investments, LLC.

By choosing an option below, the next time you return to the site, your home page will automatically

be set to this site. You can change your preference at any time.

We have saved your site preference as

Institutional Investors. To change this, update your

preferences.

United States Important Legal Information

By confirming below that you are an Institutional Investor, you will gain access to information on this website (the “Website”) that is intended exclusively for Institutional Investors and, as such, the information should not be relied upon by individual investors. This Website and any product, content, information, tools or services provided or available through the Website (collectively, the “Services”) are provided to Institutional Investors for informational purposes only and do not constitute a recommendation to buy or sell any security or fund interest. Nothing on the Website shall be considered a solicitation for the offering of any investment product or service to any person in any jurisdiction where such solicitation or offering may not lawfully be made. By accessing this Website, you expressly acknowledge and agree that the Website and the Services provided on or through the Website are provided on an as is/as available basis, and except as partnered by law, neither Guggenheim Investments and it parents, subsidiaries and affiliates nor any third party has any responsibility to maintain the website or the Services offered on or through the Website or to supply corrections or updates for the same. You understand that the information provided on this Website is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. You also agree that the terms provided herein with respect to the access and use of the Website are supplemental to and shall not void or modify the Terms of Use in effect for the Website. The information on this Website is solely intended for use by Institutional Investors as defined below: banks, savings and loan associations, insurance companies, and registered investment companies; registered investment advisers; individual investors and other entities with total assets of at least $50 million; governmental entities; employee benefit (retirement) plans, or multiple employee benefit plans offered to employees of the same employer, that in the aggregate have at least 100 participants, but does not include any participant of such plans; member firms or registered person of such a member; or person(s) acting solely on behalf of any such Institutional Investor.

By clicking the "I confirm" information link the user agrees that: “I have read the terms detailed and confirm that I am an Institutional Investor and that I wish to proceed.”